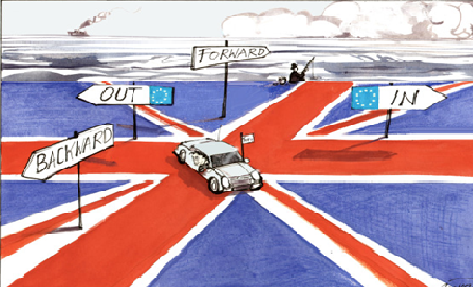

After the referendum marking the will of the United Kingdom to leave the European Union, one sector of the economy in which we might see a major impact from Brexit will be in the insurance sector.

After the referendum marking the will of the United Kingdom to leave the European Union, one sector of the economy in which we might see a major impact from Brexit will be in the insurance sector.

The internal market harmonization and the insurance sector-specific regulations over the last forty years have enabled the expansion of insurance groups and financial conglomerates in the United Kingdom, manly connected to a Community market almost free from barriers (according to the TheCityUK Association, about 17% of the London Market can be traced back to European customers – see https://www. thecityuk.com/research/a-practitioners-guide-to-brexit).

While the creation of the Solvency II directive and the Insurance Mediation Directive II and an EU-level supervisory system should further smooth out differences between EU member state’s national regulations, the vote in the UK could give rise to new scenarios, including critical issues, which companies should be ready to manage.

Although much will inevitably be influenced by the negotiations that will be conducted between the UK and the European Union in the coming months, in highly regulated industries such as the insurance ones, the most immediate consequences of Brexit could relate to the abandonment of the principles of the “EU passport” and Home Country Control.

Nowadays insurance companies authorised in the Member States where they have their registered office (known as the home Member States) may also carry out insurance activities in the territory of other EU member states, without having to request a new authorisation, being supervised (almost) exclusively by the authorities of the home member States.

If these principles were no longer applicable, freedom of the insurance industry in the United Kingdom to operate in all the European markets would be constrained by the need to apply for a new authorisation in other EU Member States, increasing costs for insurance companies which would be subject to a double supervision, causing a considerable reduction in those markets.

The disadvantages associated with the loss of a sole EU market could lead the British companies, as well as the non-EU companies authorised in UK, to decide to transfer their seat to another EU Member State, so as to continue to benefit from the advantages of a single market substantially free of barriers.

Though the foregoing may represent a source of new opportunity, it is also important to appreciate that important issues could arise not only for those EU companies operating in the UK which will decide to continue to operate there, but also for all those EU companies or businesses that, to date, operate and / or maintain commercial relations with UK insurance companies.

The potential link between the separation of the British market from Europe and a possible divergence between insurance regulations in the European Union and the UK, in part exacerbated by the current process of implementation of the Solvency II and IMD II directives, may result in a significant increase in risks, such as those associated with non- compliance with regulations, counterparty insolvency, changes of the laws applicable to pending contracts and / or assets, as well as their “prudential” evaluation.

You can consult and/or download the full version of the Brexit dossier here.

No Comments